28+ paying points on a mortgage

Web How to Calculate Mortgage Points. The points are paid at closing and listed on the loan estimate.

Mortgage Points A Complete Guide Rocket Mortgage

One discount point usually equals 1 of your total loan amount and lowers the interest rate of your mortgage around one-eighth to one-quarter of a percent.

. Web How do mortgage points work. Web A half-point on a 300000 mortgage for example would cost 1500 and lower the mortgage rate by about 0125 percent. For example a 30-year 150000 home loan might have an interest rate of 4 percent but comes with a cost of one point or 1500.

Web Buying points on a mortgage is a good idea only if you plan to make payments on your loan long enough to break even when what you paid for points equals your savings from a reduced interest rate. You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment. Web Mortgage points are an upfront lender fee that borrowers pay to get a lower interest rate on their home loan.

Web There are two types of points you can pay on your mortgage loan. To figure out when youd get. Web Mortgage points or discount points are fees that you pay to the lender upfront for discounted interest rates.

For example the loans are both fixed-rate or both. In exchange for these points youre reducing your interest rate for the life of the loan. Then say you buy two mortgage points for 1 of the loan amount each or 4000.

Web Most mortgage lenders cap the number of points you can buy. For answers to these home-purchase questions and more speak with a loanDepot licensed loan officer today. If you agree to two points youll owe 6000 at closing.

For example on a 100000 loan one point would be 1000. For example lets say you take out a 200000 30-year fixed-rate mortgage at 5125. A loan with one point should have a lower interest rate than a loan with zero points assuming both loans are offered by the same lender and are the same kind of loan.

Web Whether you should pay discount points depends on a few factors like whether youre getting a fixed or adjustable-rate mortgage your down payment and how long you plan to live in the home or keep the loan. A mortgage point is equal to 1 percent of your total loan amount. So if you borrow 300000 for a home you can expect your point to cost 3000.

Such an offer may or may not make sense for you. Web A point is the equivalent of 1 percent of the loan amount. Web Copy link to clipboard.

Discount points - a form of pre-paid interest which gives you a lower interest rate for the remainder of the loan. Web When you purchase discount points or buy down your rate on a new mortgage the cost of these points represent prepaid interest so they can usually be deducted from your taxes just like. At the current.

For example one discount point will cost you 1 of your loan amount and will lower your interest rate by 025. A mortgage point equals 1 percent of your total loan amount for example on a 100000 loan one point would be 1000. Web One mortgage point typically costs 1 of your loan total for example 3000 on a 300000 mortgage.

A month ago the average rate on a 30-year fixed refinance was lower at 648 percent. There is no set value for how much of. As a result your interest rate dips to 5.

The lowdown on Mortgage Discount Points. When you elect to pay discount points you offer to pay an upfront fee in exchange for a lower interest rate. Generally speaking one point costs about 1 of your mortgage loan amount.

Web The average 30-year fixed-refinance rate is 687 percent up 25 basis points from a week ago. Generally points can be purchased in increments down to eighths of a percent or 0125. Points increase the homebuyers closing costs because theyre paying more money upfront.

Picture a scenario where you take out a 30-year-fixed-rate mortgage. You end up saving 62 a month because your new monthly payment drops to 1074. Web On a 100000 home three discount points are relatively affordable but on a 500000 home three points will cost 15000.

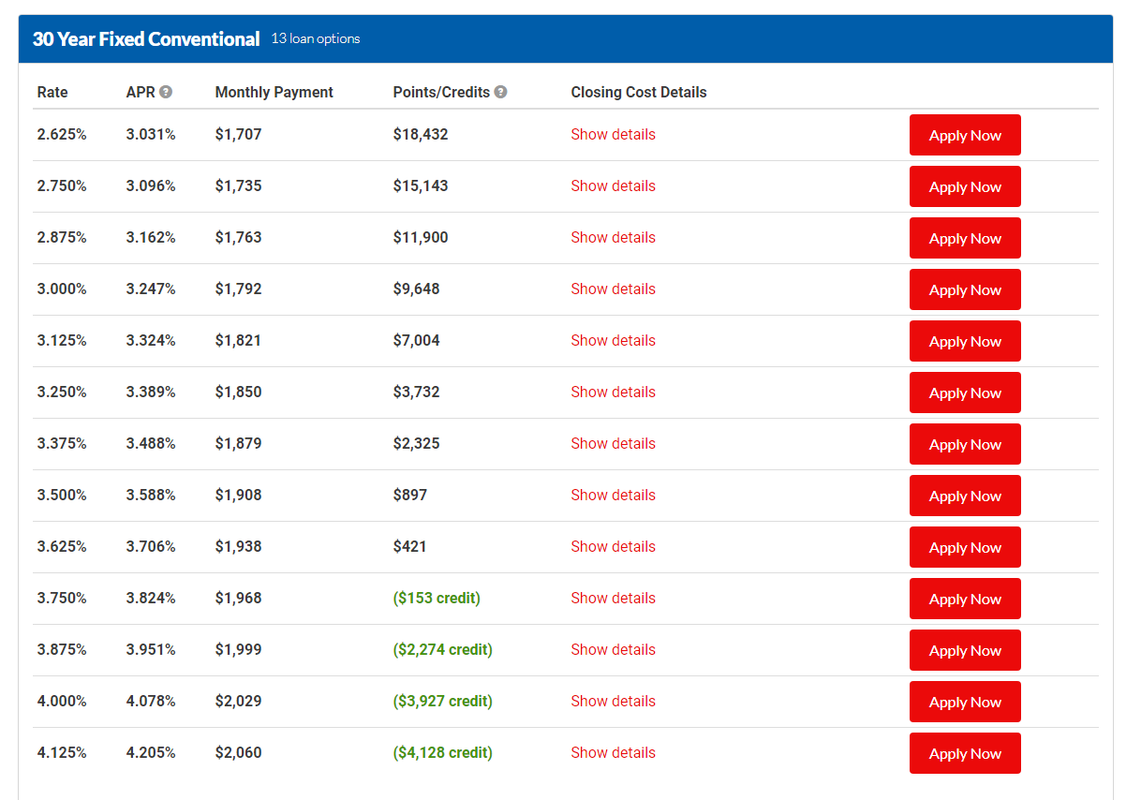

Web The table below illustrates the monthly savings from paying one or two discount points on a 200000 mortgage with a base interest rate of 5 and a 30-year term. By paying one discount point at settlement you can lower your interest rate to 325. At the same time points make the monthly mortgage payment less expensive and reduce the total amount of interest paid over the life of the.

Mortgage points are essentially a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payments a practice known as buying down your interest rate. Web Paying points lowers your interest rate relative to the interest rate you could get with a zero-point loan at the same lender. If you have to pay one point on a 200000 mortgage you will owe 2000.

Mortgage points also known as discount points are a form of prepaid interest. On top of the traditional 20 down payment of 100000 for that. With this example if you bought two points youd pay 6000 when your mortgage.

Web How Mortgage Discount Points Work. The term points is a common way of referring to a percentage of your loan amount. Origination points - fees that are charged by a mortgage broker or.

Mortgage lender makes you the following offer. How Much Does One Point Lower Your Interest Rate. Web Mortgage points also known as discount points are an option for buyers to pay an upfront fee at closing to buy down the interest rate on a loan.

Your lender offers you an interest rate of 475 if you purchase 175 mortgage points. Web To buy mortgage points you pay your lender a one-time fee as part of your closing costs. If you have cash available and plan to stay in the property for a long time it usually makes more financial sense to pay for discount points than if.

Web Typically one point will cost you 1 of your total mortgage amount.

How Mortgage Points Work And When To Pay For Them Smartasset

Paying Points How To Get Your Clients A Reduced Mortgage Rate

Help Me Understand My Lenderfi Mortgage Offer Bogleheads Org

Should You Buy Down Your Mortgage Rate Pros And Cons

Mortgage Points Calculator Nerdwallet

Mortgage Points What Are They And How Do They Work Bankrate

How Mortgage Points Work And When To Pay For Them Smartasset

42 Trending Credit Repair Businesses 2023 Starter Story

Should I Pay Points On A Mortgage Mortgage Points Explained Is Buying Mortgage Points Worth It Youtube

Mortgage Points The Homebuyer S Guide Prevu

Mortgage Points Calculator Should You Pay Mortgage Discount Points Guaranteed Rate

What Is A Mortgage Everything To Know About Home Loans Credible

Eu Council Manual Law Enforcement Information Exchange 7779 15

Buy Mortgage Points To Lower Your Interest Rate Youtube

Should You Pay Points On Your Home Loan Youtube

.jpg?sfvrsn=df131825_3)

Buy Platinum Home Mortgage Corporation

Should I Pay Points On A Mortgage Mortgage Points Explained Is Buying Mortgage Points Worth It Youtube